Negotiation

Math for Dessert

Smith Family Reserves:

The Smith Family wanted to start a family bank. The Dad contributes $90k and the Mom contributes $60k, making a total of $150k. The expenses of the Smith Family are $7,500 / month. Once they fund their family bank, they decide they want to take out 3 loans; a student loan payoff for $10,000, a bathroom update for $5,000, and a backyard jungle gym for $1,500. After each of these loans are funded, how long will the money remaining in the Smith Family Bank (their reserves) last them on their current expenses?

Reynolds Family Equity Stripping

The Reynolds Family heard about the Family Bank and wanted to perform Equity Stripping on their house. Their house was worth $300,000 and the existing mortgage they had was $100,000. They were inquiring on a Home Equity Line of Credit (HELOC) which allowed 80% loan to value for their home. What that means is that the HELOC would allow a maximum of 80% of debt based on the value of the home. If they were approved form their HELOC, how much would be the maximum they could be approved for?

Young Entrepreneur Josh

Young Entrepreneur Josh

Parsons Family have a son named Josh that wants a loan from the Parsons Family Bank. Josh was making $20 / month off of his websites. He wanted an iPhone SE2 for $400 and a one year phone plan for $150. How long would it take Josh to save up enough money from his website to afford the phone and the phone plan? If the Parsons Family agrees to a loan at 5% for a one year loan to fund Josh's phone and plan, how much more money would Josh need to bring in from his business to pay off the new loan in one year?

The Barone Family Bank

The Winslow Family Bank

Young Entrepreneur Josh

1. The Barone Family decides to start a Family Bank. Ray makes an annual salary of $80,000 a year. He commits to put a total of 15% of his salary to the Family Bank on a monthly basis. He also gets a one time contribution from his mother Marie for $50,000. The Barone Family Bank goal is to gather $100,000 deposits for their Family Bank. Assuming there are no other external contributions to their bank, How long will it take them to reach their goal?

2. The Barone Family decides to use $25,000 of the money deposited by Marie to purchase a new car. If the Barone Family Bank offers the loan for 5 years at an interest rate of 5% interest (simple interest used), how much will be the monthly payment.

3. The Barone Family wants to know if how much extra money would Debrah have to make if their family bank were to hit $100,000 of deposits within 3 years. This is assuming that the vehicle was not purchased (as in previous question) and Marie still provides an initial contribution of $50,000. If Debra gets a part time job, home much would she need to contribute to fund the gap, and what would this work out to monthly?

The Winslow Family Bank

The Winslow Family Bank

The Winslow Family Bank

1. The Winslow Family decided put together a Family Bank. Carl (a Chicago Cop) makes a salary of $50,000 / yr as a cop and his wife Harriet makes $30,000 / year as a nurse. The kids do not work. Their goal for the family bank is to save enough money for the kids' for their first year of college ($20,000 / each), or $60,000, within the next five years. What percentage of their salaries will have to be contributed into the Family Bank to hit their goal?

2. There have been riots and Carl has to work overtime. In doing so Carl increases his salary by 25% for the first three years of the Family Bank. If Carl socks away the extra money towards college, how much faster will it take for them to save enough money to go to college?

3. Steve Urkel stops by while Carl is at work to show Laura a new invention. While showing her, there is a malfunction and Steve's invention explodes. Insurance uncovers a $50,000 estimate to repair the hole in the house. The insurance policy has a $10,000 premium that Carl will need to pay to cover the costs of the repair. Steve offers to pay for the premium since he caused the damage and Carl agrees. Steve does not have the full amount, but makes $250 / month profit form his business. He will need to get a loan from the Winslow Family Bank to fund the purchase. At 6% interest rate (simple interest) including principle, how long will it take for Steve to pay back the Winslow Family Bank

The Bundy Family Bank

The Winslow Family Bank

The Winslow Family Bank

1. The Bundy Family was told about the Family Bank, they live from paycheck to paycheck. Their house is worth $150,000. Al makes $30,000 and that is only money that comes to the family. The mortgage is the only thing budgeted. The amount remaining in their mortgage was $55,000 and had eight years left. They soon get an inheritance of $30,000. Their neighbor Marcie gives them three ways to use the money. The first way is proposing for them to do a Family Bank, they put the $30,000 in the Family Bank and it rises 10% every year and create funds to fund the kids college funds, $25,000 per kids (2 kids). How long will it take them at 10% per year to save enough money?

2. The second way is that they would open an IUL (individual, universal life account) and put the $30,000 into the policy, but Peggy puts $10,000 a year in the policy, which is $50,000 but cannot take a loan. In order for the IUL policy to grow to $50,000, assume the interest rate of 5% of what is in the account. How much money will be in the account at the end of the five years? Assuming that Peggy needs $50,000 within 7 years, were there be enough money going to the other account at 5%?

3. The third idea was that the family would set up a dynasty trust and put the $30,000 into the trust to fund the insurance policies, one for each person (4). It is a total of $100,000 and it takes ten years, with a total contribution of $40,000 to start. Peggy gets the $30,000, then takes a loan for $10,000 at 5% interest. After all of that, how much is everything worth?

HELPING KIDS GET WHAT THEY WANT

HELPFUL RESOURCES

Projects

Sharing the projects that I have been working on so that they can bring you success.

A Delicious Dish

If anyone knows me, they know how much I love food. I am a big fan of pizza just like anyone else, but I love making it more than buying it. There is something about putting on your own ingredients and your own process that makes the food your own. I am a particular fan of pizza and milkshake Fridays. They are the best!

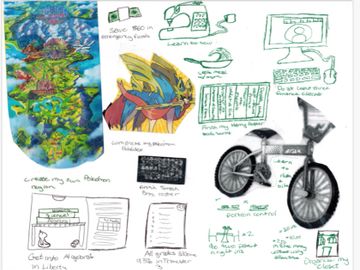

Vision Board

In order to get what you want, you have to know what it is first. You can’t have everything you want, but you can get anything that you want. My advice is to put together a vision board for exactly what you want. Be as specific as possible so that you can make it happen for yourself.

Parent's Night In

The secret for kids getting what they want is for parents to get what they want. With everyone under lockdown, the one thing we have heard that parents need most is time to themselves. Parents aren't themselves when they are grumpy, so you have to calm them down. Why not give them just that in a Parent's Night In!

Treasure Hunt

What surprised me this week was how much cool stuff I found. While I was cleaning my room I found a birthday card from my friend and it still had a gift inside - $20!!!! When I cleaned off my desk, I found a first edition Grimer Pokemon card that is worth a lot of money. The pictures I found also took me down memory lane.

Book Review

Have you ever wanted to get paid for what you love to do? Reading just so happens to be one of my super powers. My dad thought so much of it that he had me start reading books for him. He told me to put together book reviews for each so that it can give others what they want - powerful knowledge in a portion of the time!

Have fun with some of the items you have around the house. We played memorable game of mini golf with a few of the things that were collecting dust. It was a great way to use our imaginations, and we had more fund doing that than many of the things that cost money. In addition, my sister Sydney made a lot of dough when it came to running the show.

Books for Younger Readers

Click the Image for a Reading of the Book

.jpg/:/rs=w:360,h:270,cg:true,m/cr=w:360,h:270)

Tooth Trouble (Ready, Freddy) by Abby Klien

In this book, everyone loses their teeth in class, but Freddy does not. He feels bad that he is the last one to loose a tooth in his class. Eating ice cream, Freddy mistakenly swallows his lose tooth. How will he ever get money from the tooth fairy?! Funny how the same thing happened to me.

Junie B. Jones is an interesting character by herself. When you add her to different life situations, you start seeing and hearing things come out of her mouth that would only go through your mind. In Toothless Wonder, she takes everyone for a ride, parents and kids. She asks some tough questions, and that is what I like the most.

Junie B. Jones has a wild imagination. You never really know what is going to come out of her head. This one book talks about how far Junie is willing to go to become the next great hair stylist.

I had the chance to read Junie B. Jones for the first time to my family. I chose this book for my dad to read, but I lost the challenge at miniature golf today, so it was on me. Whenever we lose something, we think emotionally. Junie B. is no different than anyone else. See how shoe copes with this challenge in my delivery of this book. Just click the photo!

In this book, Junie B. goes on a field trip to a farm. She has a number of fears of what may happen, but she navigates through it the only way she knows how - by asking lots of questions. See how her trip turns out and the reactions she seems to attract from everyone she comes in contact with!

This book a good read if you like comics. It was similar to Rich Kid Smart Kit, but can appeal to younger readers. I like how the characters Tim, Red, and Tina interact with when it comes to money. I have friends with different ideas when it comes to money, so there is a character representing each person in this book.

Books for Older Readers

Books for Older Readers. Clock the photo for a narration by my dad!

Give kids power before you give them money. Money will not make you happy, control over your time to do what you want to do will. The rich don't need money because they know how to control their time. If you want to be rich, do your homework. You don't get rich at work, you get rich at home with what you choose to do in your free time.

Mindset is one of the most powerful lessons that can be received. In this book, Robert Kiyosaki talks about fundamental differences between his Rich Dad and his Poor Dad. The mindset shift this taught me is to be resourceful over being smart.

This book taught me how to tap into my logic and creativity, develop my ability to make decisions with incomplete data, and find patterns where most people neglect to look.

This book taught me that I need to learn through heuristic tasks of trial and error. If I am afraid to make mistakes with my family, in school, and in life, that will create the most long term damage. I need to not focus on how things have been done before, but have purposeful goals that allow me to create and contribute something new.

This book taught me that businesses make a lot more than employees. As individuals, we are not as strong individually as we are in a network - so we should all be working together. While money is a way to exchange and make widespread trade possible, it does not come without its own form of corruption. Price is important because it equates supply and demand, creating a balance in trade. Inflation is a tax and we must continue to increase our financial intelligence in order to thrive.

Successful people think big picture. They have dreams that they focus on and help grow. They are not scared of problems because they break them into smaller pieces. They tend to shy away from popular thinking, but value the ideas of others. Successful people are outcome oriented and enjoy time with others who create possibilities.

This book was nice in that it read like a story. I learned that financial planning is more common sense than you think. You need to pay yourself first and make sacrifices in order to achieve your goals. You also need to pick the right people to take advice from since all advice is not created equal.

This is a good book on how to be successful by looking at failure differently. Failure is not an event, it is a mindset. You can only learn and grow through mistakes, no matter what others tell you. You have to commit to your goals and your dreams with loyalty and honesty. Believe in yourself and you can become unstoppable.

Knowledge and Behavior need to work together if you want a feeling of success. Behavior is a fact and accountability is a choice. Without trust in your behavior and accountability for your decisions, it will be easy to blame yourself out of anything. Seek clarity by asking the right questions, face life with personal honesty, and take the lessons that you are learning so that you can lead of life of Happiness, Personal Fulfillment, and Freedom.

This book was highly recommended by Warren Buffet. It is a set of business stories the provide lessons learned within the context of business. I like to hear problems businesses have faced in the past because they can still have relevance today. Even though we have more methods of communication, it does not indicate that their still can't be problems in communication, like the ones I have with my parents.

How we see ourselves and how other people see us is what I took from this book. Peer pressure is something that I often hear about, but it is not something I used to think about. When it comes to parents, I would rather do it my way and not theirs. And with my friends, I can see more how I tend to follow their direction. I like receiving attention for my accomplishments, and it can be difficult when you feel others aren't supporting you. Guess that is a part of growing up.

No relationship should be taken for granted, no matter how it was formed. Social Media represents a cultural shift in how society uses the Internet. The relationships your create online need to be managed just as they are in real life. Some organizations fall short because they move their sales people to the front line of their online business, but this is where markets excel. They are willing to go beyond the fluff and offer something of true value to their customers.

Contact Us

Negotiating With The Tooth Fairy

Email: ethan@negotiatingwiththetoothfairy.com Phone: (571) 732-2220

My Blog

Ready for Negotiation Magic!

You made it! We appreciate you choosing to visit Negotiating With the Tooth Fairy. We hope that the resources here will be useful and helpful for dealing with the challenges you may have with negotiation. It does not matter whether you are a parent or a kids - we want you to get what you want! Submit your question to us and receive the free guide to running a Parent's Night In.